Getting started with LiveTrader is very easy, you can create a free account and get set up in minutes. Creating an account is simple, just enter your email and your desired password and you’re all set.

From here you can familiarize yourself with the platform, we have many different features to help you enhance your trading, there’s Backtesting to experiment and quickly iterate on your strategies, Paper Trading to test your strategy and trade risk-free in near-market conditions to evaluate if it’s meeting your performance goals and risk levels. Then there’s Live Trading, but we’ll get to that later on, for now, let’s focus on Backtesting.

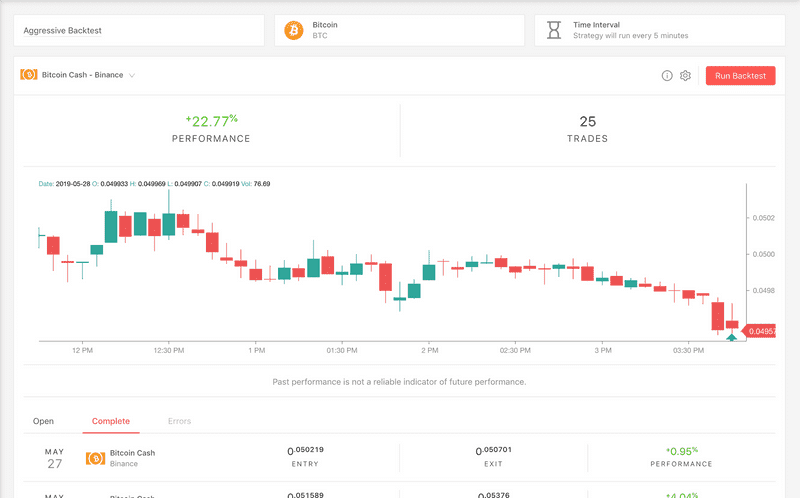

Backtesting

Backtesting is an important part of developing a trading strategy. Your strategy will be calculated against historical market data to help you to gain insights into how your strategy would have traded in certain market environments.

Because cryptocurrency markets are fast moving, it’s always best to Backtest your strategy, then Paper Trade with it to ensure it’s meeting your performance goals and risk levels.

When you first create your Backtest Strategy you’ll be asked for an initial coin, this is the Quote, usually this is coins like BTC, USDT, ETH etc. This is the coin your strategy is trying to increase when your bots are trading.

Your Strategy is where all of the logic happens, you can instruct your bots when to buy, or when to sell, depending on the various indicators you choose.

Indicators come in all different types, but for now we’ll focus on just Technical Indicators which are used for Technical Analysis. Some indicators include MACD, RSI, SMA.

You can choose the indicators which will make up your trading strategy in the menus which appear when you click the ”+” buttons. It’s best to experiment with different indicators and configurations via the Backtesting tool rather than Paper Trading or Live Trading as it allows you to quickly iterate on your strategy and try new ideas you may have for strategies to get your edge on the crypto markets.

Backtesting on LiveTrader is a very fast way to experiment with new indicators

Backtesting on LiveTrader is a very fast way to experiment with new indicators

Tip: Enable the Automatic Backtest option so you can run backtests faster without having to manually run them each time.

During backtesting you also have the option to change settings such as Slippage, Fees etc, these can help you estimate how much you’re likely to spend on trading fees or price slippage during volatile market conditions.

Once you’re happy with the performance results you’re seeing in your Backtests, you can move onto Paper Trading to start testing how your strategy will perform in near-market conditions.

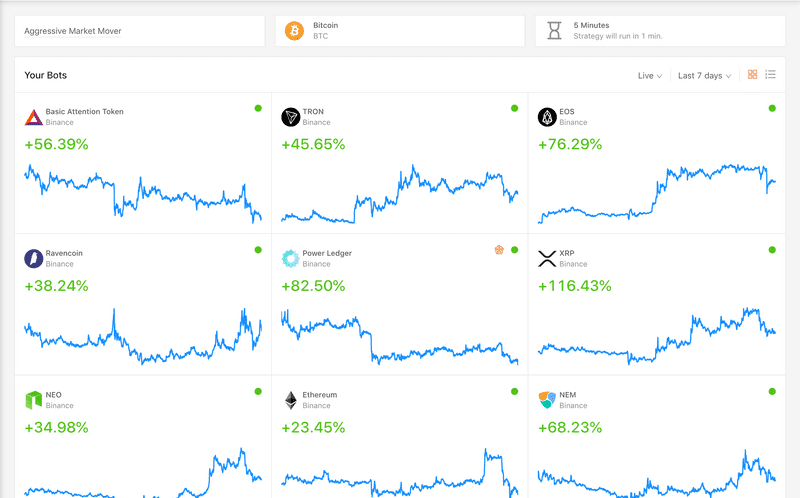

Paper Trading

Paper trading allows you to trade using your strategy across various pairs and even various exchanges at once in near-market conditions. It’s completely risk-free because you don’t connect your exchange and the trades which your bots make, are not real, they’re “paper”, meaning they’re more like a log of trades, rather than actual trades executed on an exchange.

A bot is really just a pair on the exchange you want your strategy to trade 24/7. This can be something like LTC/BTC where it would trade Litecoin using your Bitcoin balance on your exchange.

When you first create your strategy you’ll notice the setup is similar to the Backtesting Strategy setup, choose the same settings as you chose for your Backtest.

You’ll then be asked to choose a Bot pair, depending on how you’ve configured your strategy, different pairs will perform differently as you may have noticed during Backtesting.

Select the “Paper Trading” option to finish off creating your bot. It’s really that easy, now your bot will trade without you having to do a thing so you can check back later to see how your strategy has performed paper trading.

Feel free to add other bots and tweak your strategy while you evaluate it.

Gain valuable insights in your bot’s trades via the Strategy Dashboard

Gain valuable insights in your bot’s trades via the Strategy Dashboard

Tip: You can click into each bot to get an overview of the market and visualize what your strategy is currently signaling.

Paper trading is great because it allows you to simulate the trading conditions of live markets without you having to risk any of your funds. You can run the paper trading for as long as you like until you’re comfortable with your strategy and the performance of your bots.

Now that your bots are configured and set up, they will start trading 24/7 automatically for you. They will follow your strategy and buy/sell without you having to interact with them, or be online for it to happen.

LiveTrader is cloud-based, meaning you don’t need to host anything or leave your computer on all the time for your bots to trade. You can check your strategy and bots on the go via your phone.